Financial Algebra combines mathematical concepts with practical financial applications‚ offering tools to solve real-world monetary problems. It bridges algebraic methods with personal finance‚ investments‚ and budgeting strategies‚ empowering individuals to make informed decisions about money management and long-term financial planning.

1.1 Overview of Financial Algebra

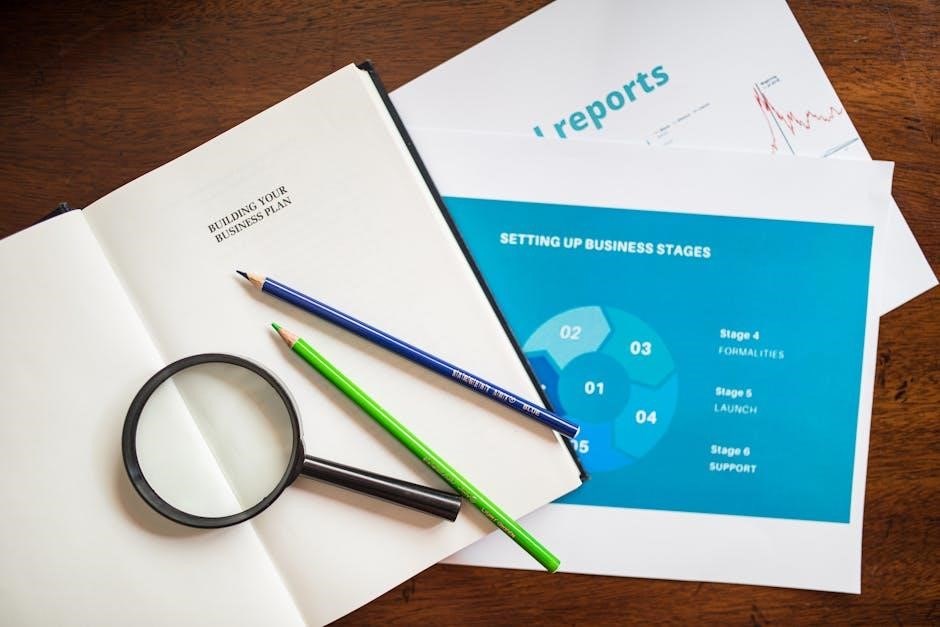

Financial Algebra integrates algebraic techniques with financial concepts‚ providing practical tools for managing money‚ investments‚ and debt. It covers topics like time value of money‚ retirement planning‚ and credit card calculations‚ offering real-world applications. This field equips individuals with skills to make informed financial decisions‚ from budgeting to portfolio management. Resources such as workbooks and online courses supplement learning‚ while solution manuals and teacher editions provide additional support. Financial Algebra is essential for understanding personal finance and navigating complex monetary systems effectively‚ making it a valuable asset for both students and professionals seeking financial literacy.

1.2 Importance of Financial Algebra in Modern Finance

Financial Algebra is crucial in modern finance as it provides mathematical frameworks for analyzing financial data‚ optimizing investments‚ and managing risks. Its principles enable professionals to calculate returns‚ assess creditworthiness‚ and develop strategic financial models. In a global economy driven by data and precision‚ Financial Algebra equips individuals with the skills to navigate complex monetary systems and make informed decisions. It bridges the gap between theoretical mathematics and practical applications‚ making it indispensable for personal finance‚ corporate strategy‚ and economic planning‚ ultimately fostering financial literacy and stability in an ever-evolving market landscape.

Key Topics Covered in a Financial Algebra Textbook

A Financial Algebra textbook covers essential topics like time value of money‚ investment analysis‚ retirement planning‚ credit card debt‚ and risk management strategies.

2.1 Time Value of Money

The time value of money is a foundational concept in financial algebra‚ explaining how money’s value changes over time due to factors like inflation and interest rates. It teaches individuals to calculate present and future values of cash flows‚ enabling better decision-making for savings‚ investments‚ and loans. Understanding compound interest‚ annuities‚ and depreciation helps in evaluating financial opportunities and risks. This concept is crucial for planning retirement‚ managing debt‚ and assessing investment returns‚ making it a cornerstone of personal and corporate finance strategies.

2.2 Investment Analysis and Portfolio Management

Investment analysis and portfolio management involve evaluating financial assets and constructing diversified portfolios to maximize returns while minimizing risk. Financial algebra provides tools to assess investments‚ such as calculating net present value (NPV)‚ internal rate of return (IRR)‚ and portfolio variance. It also explores strategies for asset allocation‚ diversification‚ and rebalancing to align with financial goals. By applying algebraic models‚ individuals and institutions can make data-driven decisions‚ ensuring optimal investment outcomes and long-term financial stability in dynamic market conditions.

2.3 Retirement Planning and Pension Funds

Retirement planning and pension funds require careful financial strategies to ensure long-term security. Financial algebra helps calculate future retirement needs‚ such as determining required savings rates and portfolio growth. It also models pension fund operations‚ including contributions‚ returns‚ and payout structures. Algebraic tools enable individuals to assess retirement readiness and optimize investment choices. Additionally‚ understanding concepts like compound interest and annuities is crucial for making informed decisions about retirement savings and income generation‚ ensuring a sustainable financial future.

2.4 Credit Card Debt and Loan Calculations

Financial algebra provides essential tools for managing credit card debt and loans. It helps calculate interest rates‚ minimum payments‚ and total costs over time. Algebraic models enable individuals to understand how compounding interest affects debt accumulation and repayment. Strategies for paying off debt‚ such as the avalanche or snowball method‚ can be analyzed using algebraic techniques. Additionally‚ algebra aids in comparing loan options‚ calculating payback periods‚ and determining the impact of extra payments on reducing debt. These calculations empower individuals to make informed financial decisions and achieve debt freedom more efficiently.

2.5 Risk Management Strategies

Financial algebra introduces strategies to manage and mitigate risks in investments and personal finance. It explores the use of algebraic models to assess potential losses and gains‚ helping individuals make informed decisions. Techniques include probability analysis‚ diversification of portfolios‚ and hedging against market fluctuations. Algebraic equations are used to calculate risk ratios‚ interest rates‚ and the impact of economic changes. These tools enable individuals to identify and minimize financial pitfalls‚ ensuring more secure and stable monetary outcomes. Understanding risk management through algebra empowers individuals to navigate financial markets with confidence and precision‚ safeguarding their assets effectively.

How to Download a Financial Algebra Textbook PDF

Popular platforms like Internet Archive and educational websites offer free PDF downloads of Financial Algebra textbooks. Search for the title‚ select the PDF option‚ and download securely.

3.1 Popular Platforms for Downloading Financial Algebra Textbooks

Popular platforms for downloading Financial Algebra textbooks include the Internet Archive‚ educational websites‚ and online repositories. These platforms offer free or paid access to PDF versions of textbooks like Financial Algebra by Robert K. Gerver. Users can search for specific titles‚ browse collections‚ or use filters to find relevant materials. Many platforms also provide additional resources‚ such as workbooks or solution manuals‚ to complement learning. Ensure to verify the credibility of the source before downloading to avoid unauthorized or incomplete content.

3.2 Steps to Download a Financial Algebra Textbook PDF

To download a Financial Algebra textbook PDF‚ visit a reputable platform like the Internet Archive or an educational website. Search for the title‚ such as Financial Algebra by Robert K. Gerver. Locate the PDF file and click the download link. Some platforms may require account creation or verification. Ensure the file is in PDF format and review its contents before saving. Always verify the source’s credibility to avoid unauthorized downloads. Follow on-screen instructions to complete the process and access your textbook for study or reference purposes.

3.3 Tips for Using the PDF Effectively

To maximize the use of your Financial Algebra PDF‚ organize the content by bookmarking key chapters and sections. Use the search function to quickly locate specific topics like time value of money or investment analysis. Highlight and annotate important formulas and concepts for easy reference. Print relevant sections for offline study or create digital flashcards for revision. Utilize the table of contents to navigate seamlessly and cross-reference related material. Regularly sync your PDF across devices for accessibility and consider using a dedicated PDF reader for enhanced functionality and note-taking capabilities.

Additional Resources to Supplement Learning

Supplement your learning with workbooks‚ online courses‚ and solution manuals for in-depth practice. Utilize teacher editions for comprehensive explanations and access digital tools for enhanced understanding and retention.

4.1 Financial Algebra Workbooks and Exercise Manuals

Financial Algebra workbooks and exercise manuals provide hands-on practice‚ reinforcing concepts like time value of money and investment analysis. These resources include step-by-step solutions and real-world examples‚ helping students master practical financial math. Many workbooks‚ such as the Financial Algebra Workbook 1-3‚ are designed to align with textbook content‚ offering targeted exercises for topics like credit card debt and retirement planning. Additionally‚ platforms like the Internet Archive offer free access to PDF versions of these manuals‚ making it easier for students to practice and review key financial algebra problems.

- Aligns with textbook content for focused practice.

- Includes real-world financial scenarios.

- Available in PDF format for easy access.

4.2 Online Courses and Tutorials

Online courses and tutorials are excellent resources for mastering financial algebra‚ offering interactive lessons and practical examples. Platforms provide free teacher-led courses for grades 9-12‚ blending math with financial literacy. These courses cover topics like investments‚ retirement planning‚ and credit card debt‚ helping students apply mathematical concepts to real-world scenarios. Many tutorials include Desmos activities‚ enhancing learning through interactive tools. Additionally‚ online resources such as solution manuals and YouTube tutorials supplement coursework‚ making complex financial algebra topics more accessible and engaging for learners of all levels.

- Interactive and practical learning experiences.

- Covers key financial topics in depth.

- Supplemented by additional online resources.

4.3 Solution Manuals and Answer Keys

Solution manuals and answer keys are invaluable resources for students studying financial algebra. These materials provide detailed explanations for complex problems‚ helping learners understand the correct methods for solving equations and applying financial concepts. Answer keys offer quick verification of homework and practice problems‚ while solution manuals break down step-by-step processes. Many of these resources are available in PDF format‚ making them easily accessible for study and review. By using these tools‚ students can reinforce their understanding and improve their problem-solving skills in financial algebra.

- Provides detailed explanations for complex problems.

- Offers step-by-step solutions for better understanding.

- Available in PDF format for easy access.

4.4 Financial Algebra Teacher Editions

Financial algebra teacher editions are comprehensive resources designed for educators. These editions often include instructor manuals‚ lesson plans‚ and additional problem sets tailored for classroom use. They provide teachers with tools to effectively convey financial algebra concepts‚ ensuring students grasp both mathematical and practical applications. Many teacher editions are available in PDF format‚ offering flexibility for digital classrooms. These resources may also include answer keys‚ teaching tips‚ and assessment materials‚ making them indispensable for educators seeking to enhance their students’ understanding of financial mathematics.

- Includes instructor manuals and lesson plans.

- Provides additional problem sets for classroom use.

- Available in PDF format for digital accessibility.

- Enhances teaching of financial algebra concepts.

Common Challenges in Understanding Financial Algebra

Students often struggle with translating financial scenarios into algebraic equations and applying mathematical models to real-world financial problems. Practical applications can be complex and overwhelming.

- Difficulty in grasping financial concepts.

- Challenges in applying algebraic methods to money management.

5.1 Difficulties in Grasping Financial Concepts

Students often face challenges in connecting algebraic principles to real-world financial scenarios‚ such as budgeting‚ investing‚ and credit management. The complexity of translating financial problems into mathematical equations can be overwhelming. Additionally‚ understanding financial jargon and applying algebraic methods to practical situations requires a strong foundation in both math and finance. These difficulties highlight the need for clear‚ step-by-step guidance and practical examples to bridge the gap between theory and application.

- Complexity of financial terminology.

- Difficulty in applying algebra to real-world money matters.

5.2 Tips for Mastering Financial Algebra

To excel in financial algebra‚ start by building a strong foundation in basic algebraic principles; Regular practice with exercises from workbooks or online resources helps reinforce concepts. Break down complex financial problems into simpler equations‚ and use real-world examples to contextualize learning. Leveraging solution manuals and online tutorials can provide clarity and additional practice opportunities. Consistent effort and practical application are key to mastering financial algebra and applying it effectively in personal finance and career settings.

- Practice regularly with exercises and workbooks.

- Use real-world examples for better understanding.

- Seek additional resources for clarity and practice.

Financial algebra is a powerful tool for navigating modern finance‚ offering practical skills to manage money‚ investments‚ and retirement planning. By mastering its principles‚ individuals can make informed decisions and achieve financial stability. With resources like PDF textbooks‚ workbooks‚ and online courses readily available‚ learning financial algebra is more accessible than ever. Consistent practice and application of these concepts ensure long-term financial success‚ making it an essential skill for personal and professional growth in today’s economy.